Members receiving a TRIS are able to access some superannuation benefits, without having to retire or leave their job, subject to 10% maximum withdrawals cap.

As a non-commutable income stream, there are certain restrictions on the circumstances in which the TRIS can be commuted.

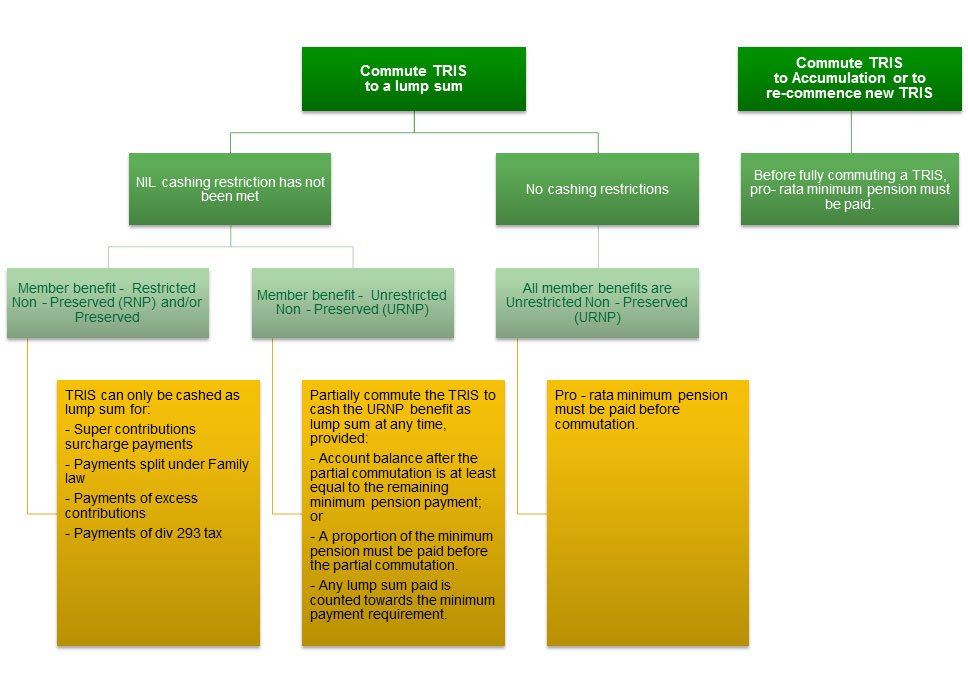

The following flowchart outlines the trips and traps advisers need to consider.