A SMSF with an annual turnover of less than $75,000 is not required to register for GST, but can opt to do so.

Since annual turnover for GST purposes does not include input-taxed supplies, a SMSF that invests only in shares, units in unit trusts and/or residential property is not required to register for GST.

Nevertheless, commercial rent received by the fund is a taxable supply (i.e. not input-taxed) and therefore, a SMSF that earns commercial rent of $75,000 or more per annum must register for GST. Consequently, the application of GST for a SMSF is usually restricted to commercial property transactions.

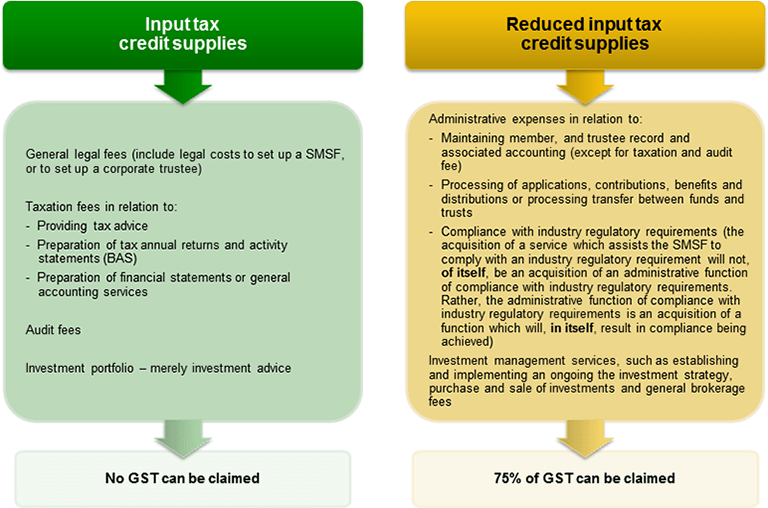

On the other hand, claiming GST input credits is not as straightforward. The ATO has highlighted common mistakes that SMSF practitioners make in incorrectly classifying taxable supplies, in particular reduced input tax credit.

Acquisitions that relate to making financial supplies that attract a reduced input tax credit are listed in sub regulation 70-5.02(2) of the New Tax System (GST) Regulations 1999. The level of recovery of GST on these eligible acquisitions is set at 75 percent.

The following diagram provides a summary of acquisitions of financial supplies that are often not claimed correctly:

When the expenses are paid by other entities on behalf of the SMSF for administrative convenience, such payments must be treated as contributions (TR 2010/1). The ATO considers such expenses as creditable acquisitions for the SMSF and not for the contributors. Hence the SMSF is entitled to claim the GST credits.

To avoid tax penalties and interest charges, it is worthy to ensure that GST is recorded and reported correctly.