The speculation over Australian economic downturn and rising unemployment has motivated trustees to invest overseas. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997.

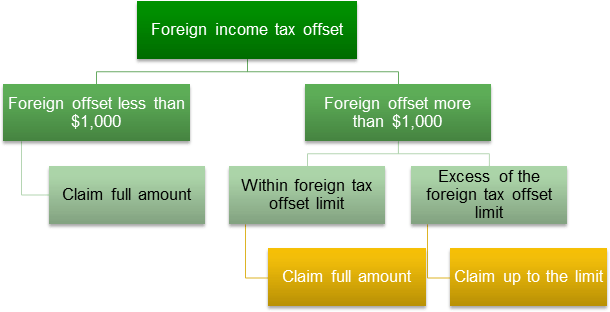

The foreign tax credits can generally be claimed up to the amount of Australian tax paid. If the foreign tax offset claimed is less than $1,000, the actual amount of foreign income tax paid must be included in the tax return. However, if the foreign tax offset claimed is more than $1,000, the foreign tax credits can only be claimed up to a limit based on the requirements of Section 770.75 of the Income Tax Assessment Act 1997.

The decision tree below explains the workings of the amount that can be claimed as foreign income tax offset:

Below is a simple case study to show how foreign income tax offset can be claimed in the tax return:

Jane, a director of the corporate trustee of the Smith Superannuation Fund, has Australian and foreign income and expenses for the year ended 30 June 2015 as follows:

| Interest from Australia | $200 |

| Gross dividends from overseas | $18,000 |

| Deductible expenses from Australia | $7,000 |

| Foreign income tax offset | $3,000 |

For the financial year ended 30 June 2015, Smith Superannuation Fund has a tax liability of $1,680, resulting from a 15% tax on the taxable income of $11,200.

Since the Fund has Australian deductible expenses of $7,000 i.e. more than Australian assessable income of $200, its tax liability on Australian income will be nil.

Therefore, the foreign income tax offset is limited to $1,680, which is the Australian tax paid on that foreign income.

It is important to note that any foreign income tax offset in excess of the limit, for instance $1,320 ($3,000 – $1,680), is not refundable and cannot be carried forward to later income years.