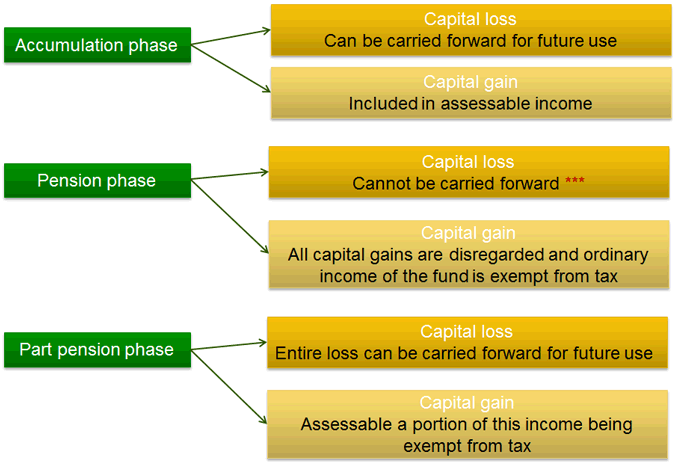

This is one of the more common questions we get asked and seemed like a good topic for our blog. We present you with simple diagram that should assist you with understanding the current legislation. Please note that this diagram disregards the impact of any proposed changes announced by the Federal Government on 5 April 2013.

*** Capital losses recorded before the fund converts to a 100% pension phase are crystalised and available for future use.