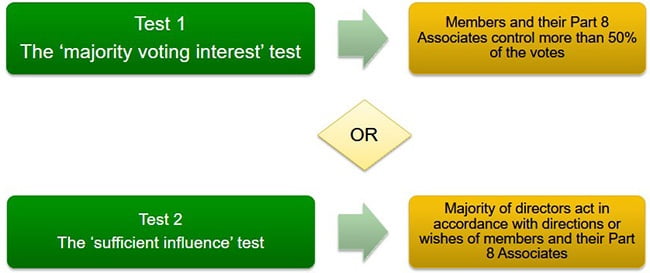

Under section 70E(1) of SISA, a company will deemed to be a related party of the self-managed superannuation fund if it satisfies one of the following two tests:

Test 1 is not satisfied where members or their Part 8 Associates own exactly 50% of the shares. In this instance, the ‘sufficient influence’ test will have to be examined closely.

Unfortunately, the ‘sufficient influence’ test is very subjective and will have to be considered on a case-by-case basis. Below are some key examples and aspects of how Test 2 could be triggered:

Substantial shareholder

If 50 per cent of the remaining shareholding is held by a relatively small group of investors and decisions are based on majority votes, then arguably the member may effectively have control over the company.

No input from co-directors in management

If the co-directors do not play an active role in management of the company and are appointed only to create an appearance of independence, it may indicate the existence of practical control in the company and consequently, Test 2 will be potentially satisfied.

Casting votes

Often constitutions give directors a second vote or casting vote in the event of a tie. This would support a conclusion that the company is sufficiently influenced by members.

To summarise, it is important to see the substance of the transaction rather than form to determine if sufficient influence is satisfied.