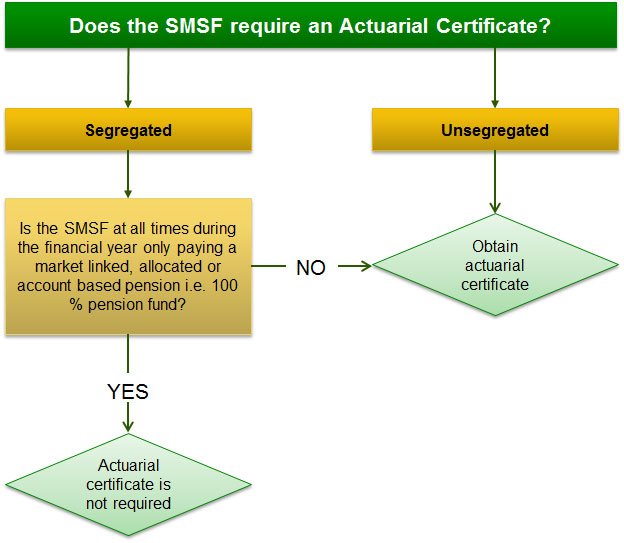

This is one of the most common questions we get asked. We present you with simple follow chart that should assist you with your decision.

Per QC 67058 issued by ATO on 15 Oct 2021, Funds that are fully in retirement phase for all the income year, with disregarded small fund assets, will not be required to obtain an actuarial certificate for their 2022 SMSF Annual Return and later income years.

Kindly note: Funds with a defined benefit pension require an adequacy statement of opinion from an actuary each financial year to determine that the Fund has sufficient assets to meet its liabilities. Therefore, the decision tree below will not apply for funds with defined benefit pension.