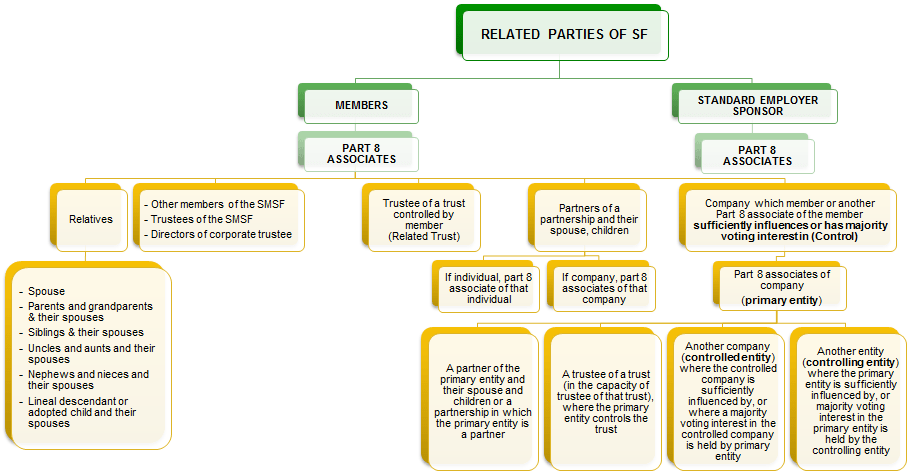

For an SMSF, the term “related party” is relevant for the purposes of the prohibition on the acquisition of assets by the fund and the in-house asset investments of SMSF.

A “related party” of a superannuation fund means any of the following:

- A member of the fund or a “Part 8 associate” of a member

- A standard employer–sponsor of the fund or a Part 8 associate of a standard employer-sponsor of the fund (SIS Act s 10(1)).

It is imperative to understand who is a related party of the fund to ensure that any transactions undertaken by the SMSF are permissible within the requirements of the legislation.

The definition of Part 8 associate is convoluted and therefore I have prepared a flowchart to simplify the definition: