Section 17A of the SIS legislation sets out the conditions that a fund must satisfy in order to be a SMSF. One important requirement is that each member of an SMSF must also be a trustee of the fund or a director of the corporate trustee. Except in the case of single member funds, each trustee or director of the corporate trustee, is also a member of the SMSF.

However, in certain circumstances, it is impossible for the member to perform the trustee functions such as:

- Member is going overseas for an indefinite period of time, or

- Member has a temporary illness, or

- Member becomes incapacitated

Under such circumstances for those who do not want to wind-up their self-managed superannuation fund, a viable strategy is to substitute the Trustee using an enduring power of attorney (EPA).

This is because section 17A (3)(b)(ii) of the SISA allows a Legal Personal Representative (LPR) who holds an EPA to be appointed as a trustee or a director of the trustee company in place of the member without causing the fund to cease to be an SMSF.

When the trustees decide to set up an EPA, it is important that the power of attorney must be enduring and in accordance with SIS and other relevant legislations.

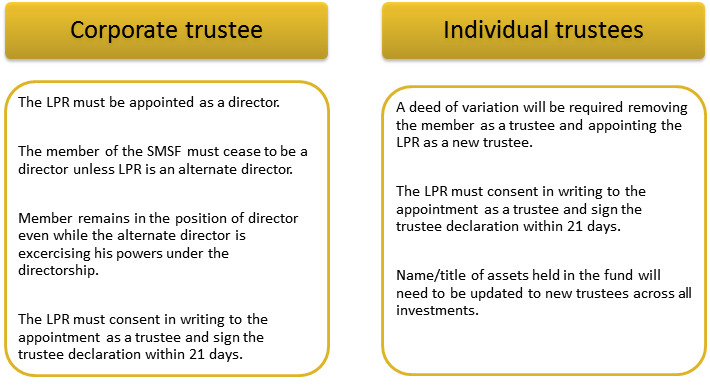

The following steps need to be undertaken whilst appointing a Legal Personal Representative: